What makes a happy retirement is likely to be different for everyone. You might want to travel the world, enjoy your favourite hobbies, or spend more time with your grandchildren.

Whatever your ambitions, financial security could be the key to turning these dreams into reality.

A recent study by Legal & General, in collaboration with the Happiness Research Institute, found that having a stable income often provides the foundation for a happy retirement.

Read on to find out why this might be and discover three practical tips for building the wealth you need to fully enjoy your life after work.

94% of adults in the UK say their most important retirement dream is financial security

A previous survey commissioned by Legal & General in 2023 revealed how important financial security is to UK retirees.

When asked about their retirement priorities, nearly all respondents (94%) said that “feeling financially secure for the rest of my life”, and “being financially able to maintain the lifestyle I want in retirement”, were the most important factors.

This finding highlights an important link between financial security and overall happiness in retirement.

Financial stability could help you cope with economic challenges

In recent years, economic challenges, such as the cost of living crisis, higher inflation levels, and fluctuating interest rates, have rarely left the headlines.

Retirees with a fixed income may be especially vulnerable to such financial pressures.

Indeed, in February 2024, the Pensions and Lifetime Savings Association increased the Retirement Living Standards across all levels. The annual cost of a moderate retirement rose from £23,300 to £31,300 for a single person, and from £34,000 to £43,100 for a couple, representing a 34% and a 27% increase respectively.

So, perhaps it’s unsurprising that the 2023 Legal & General study revealed that 41% of UK adults said they needed more money than expected in retirement. Additionally, PensionsAge has reported that increasing costs have forced many retirees to return to work.

In contrast, carefully planning and saving to ensure your long-term financial stability could help you cope with such economic challenges without compromising your retirement plans.

Unfortunately, no one can predict exactly what’s around the corner. Yet, being in a position to cover unexpected expenses, such as rising inflation or later-life care, might help you avoid the stress and anxiety of financial uncertainty.

This resilience could play a crucial role in creating a happy retirement.

Building your retirement fund could unlock multiple “happiness factors”

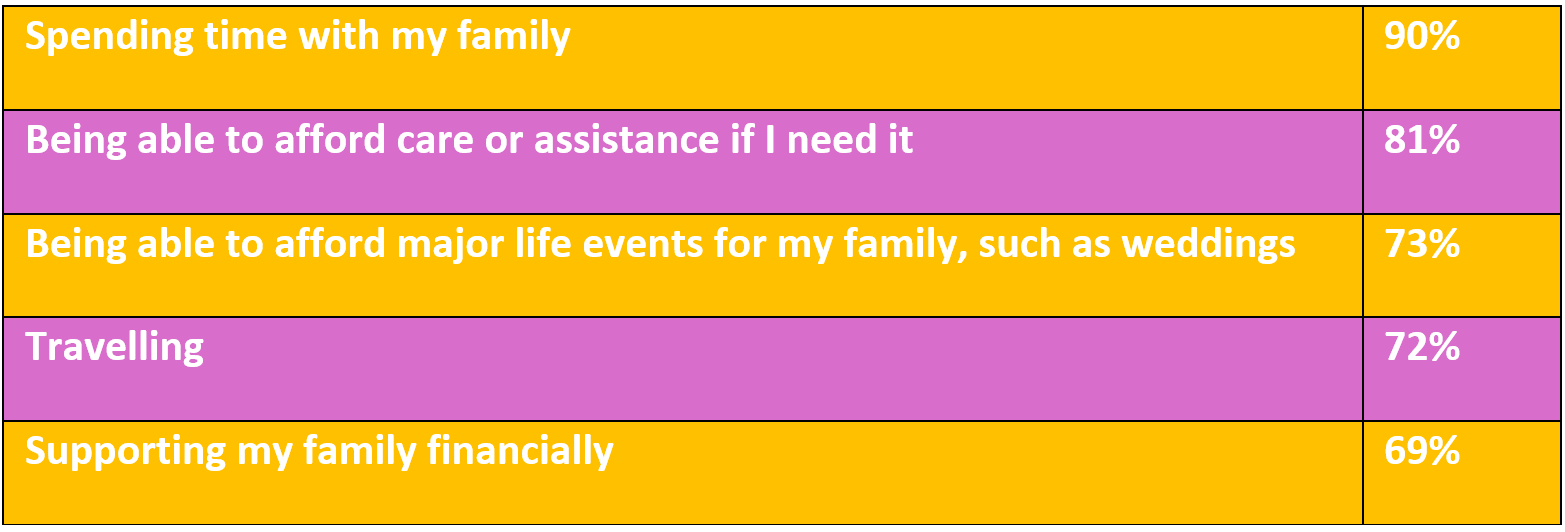

After “financial security”, the 2,000 UK adults who responded to the Legal & General survey said that these expectations were the most important to them in retirement:

Source: Legal & General

Whatever your priorities are for your retirement, creating a predictable income could be the secret to making these expectations a reality.

Remember, the earlier you start planning and saving for your retirement, the more time you will have to build the wealth you need.

By thinking carefully about your retirement goals now, and crafting a financial plan for achieving them, you could ensure your financial wellbeing in later life.

3 helpful tips for building financial stability in retirement

Careful preparation and planning are essential for building the financial stability you need for a happy retirement.

Here are three practical tips to consider that could help you achieve the security you want.

1. Identify your retirement goals

Understanding how you want your retirement to look could help you calculate your future income needs. Are you looking forward to indulging in your favourite hobbies and spending more time relaxing at home? Or is your priority to provide financial support to your children and grandchildren?

Once you have clear goals in mind, you can review your finances to determine whether you’re on track to achieve the retirement lifestyle you desire.

It’s important to consider when you want to retire as well as how you want to spend your time. The earlier you retire, the more wealth you may need to accumulate to achieve the financial stability you need.

2. Review your pension contributions

Saving into a workplace pension can be a tax-efficient way to boost your retirement fund.

You’ll receive tax relief on any contributions you make up to your Annual Allowance. For 2024/25, this is £60,000 or 100% of your earnings, whichever is lower. If your income exceeds certain thresholds, or you have already flexibly accessed your pension, your Annual Allowance may be lower.

The level of tax relief you’ll receive depends on which Income Tax band you fall into. If you’re a higher- or additional-rate taxpayer, you could claim 40% or 45% respectively through your self-assessment tax return. This means that if you are an additional-rate taxpayer, a £1,000 contribution may only “cost” you £600.

So, if it’s been a while since you reviewed your pension contributions, it’s worth checking whether these align with your retirement goals. For example, if you have been auto-enrolled into your employer’s pension scheme, you might want to increase your contributions beyond the default amount.

3. Consider purchasing an annuity

An annuity is an insurance product you could buy with your pension savings that will provide a guaranteed fixed, regular income, often for the rest of your life.

So, purchasing an annuity may be a useful way to achieve the financial stability you hope for in retirement. It could also provide invaluable peace of mind – you’ll know that you have a reliable income, whatever unexpected financial shocks occur.

However, annuities are not suitable for everyone. They lack flexibility and if you use your pension savings to purchase an annuity, you’ll miss out on any potential future growth your savings might have benefited from if you’d stayed invested.

So, it’s worth speaking to your financial planner who can advise you on the most suitable options for building a financially stable retirement, taking into account your specific circumstances and aspirations.

Get in touch

If you’d like to know how we can help you plan for a financially stable and happy retirement, we’d love to hear from you.

To find out more, please get in touch. Email hello@sovereign-ifa.co.uk or call us on 01454 416653.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Workplace pensions are regulated by The Pension Regulator.

Approved by Best Practice IFA Group 17/12/2024.